Multi-Family Prospecting in RPR Commercial

Last month we showed you how to access and run a BOTE (back of the envelope) investment analysis for multi-housing opportunities. Here’s the article: Multi-Family ROI Analysis in RPR Commercial.

This time we’re going to dive a little deeper and learn how to prospect for multi-family clients in RPR (Realtors Property Resource).

Let’s take a look at what multi-family home investing is and isn’t, and why it’s a smart angle for commercial real estate investors, especially first timers.

Multi-family property primer

Multi-family properties are usually apartment or condo buildings that consist of five or more units. (A multi-family building that is two to four units, is considered a residential multi-family, although the terms are quite often used interchangeably.)

Other types of multi-family buildings include those that combine residential units with commercial spaces, such as offices, retail and dining establishments. Some low income housing and 55 and older housing also meet the criteria for multi-family buildings.

Why should clients invest in multi-family?

As far as commercial real estate investing goes, multi-family properties offer some clear advantages:

Take a guided tour of RPR’s multi-family prospecting feature

As you can see, multi-family properties offer a slew of advantages for the right client/investor. Now, you just have to figure out where those buildings are, who owns them, and how to reach them. That’s where RPR Commercial and our multi-family prospecting guided tour come in!

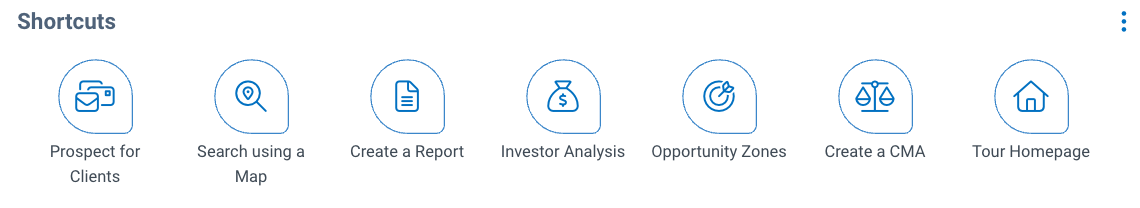

In the RPR website, there are all different kinds of “Shortcuts” or guided tours that walk you through features of the platform. From the home page you can click a button and learn how to:

- Prospect for Clients

- Search using a Map

- Create a Report

- Investor Analysis

- Opportunity Zones

- Create a CMA

- Tour Homepage

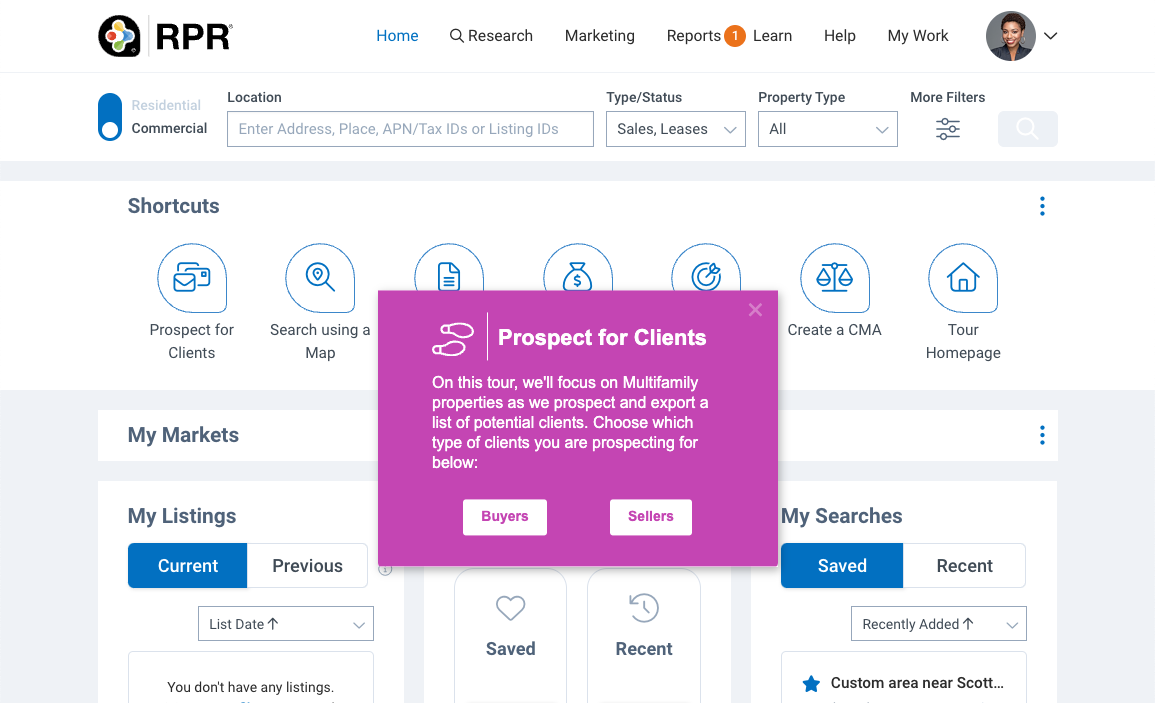

And when it comes to Multi-family prospecting, we’ve got you covered. Simply click into this link and follow the steps. You should see:

Follow the wizard and make your way through the journey. The magenta colored boxes will tell you exactly what to do.

You’ll need some information, including addresses and ZIP codes for area searches to find target properties, that you’ll be directed to type in as you progress through the tour.

In the last step, with the RPR Mailing Labels feature, you’ll be able to create a list of all the properties in your search area that fit within your search criteria. You can then export this information into a CSV (Comma-Separated Values) file.

Your multi-family prospecting cheat sheet is here

This file is your prospecting cheat sheet! With it, you have the street address of the property, the owner’s or owners’ name, the tax address (which is often the owner’s mailing address), the city, state, and whether or not the person is on a “Do not mail” list.

You can now pinpoint potential multi-family property owners for your investment clients! You can look for properties that are in distress, you can find ones that have gained significant equity and the owners might be ripe to sell, or buildings in a particular neighborhood or area that you know is ready for growth opportunities.

And you can send them marketing mailing pieces to gauge their interest: try postcards, flyers, personal letters, or run property reports and send them in a big envelope to stand out from the rest of the clutter. You might even be able to track down a contact number with their name and address information.

Use RPR Commercial and our guided tour to get your hands on a multi-family prospecting cheat sheet today.

Share This Story, Choose Your Platform!

TOPICS

AUDIENCE

CATEGORIES

TUTORIALS & GUIDES

SUCCESS STORIES

PROSPECTING

THE PODCAST