Multi-Family ROI Analysis in RPR Commercial

RPR (Realtors Property Resources) offers commercial practitioners access to an array of business-building tools: Site Selection and Trade Area Reports that utilize Esri consumer segmentation data, and recently added commercial comps from CompStak.

Not to mention 846K listings. 57 million off-market properties, traffic data, points of interest and climate risk assessment. However, one capability is flying a bit under the radar: BOTE (back of the envelope) ROI analysis for multi-family properties.

This helpful resource enables commercial specialists to quickly vet and qualify multi-family investment opportunities before undertaking a full, detailed analysis. The ability to evaluate a project’s potential in minutes rather than hours is a time-saving, efficient move.

Here’s how to do it in RPR…

RPR BOTE: Back of the envelope ballparking and guesstimating

Before we dive into the walkthrough, and in case you’re not familiar with the term, here’s the definition of “Back of the envelope”: a rough calculation, typically jotted down on any available scrap of paper such as an envelope. It is more than a guess, but less than an accurate calculation or mathematical proof.

It’s basically a ballpark figure, based on some starting numbers, that when run through a quick formula, lets agents and investors know if a project or purchase is worth the investment.

To find the BOTE assessment calculator in RPR, go to the site, toggle to Commercial, and search for a property.

Once you have your property, you will see the commercial Property Details and Property Information for that address. Scroll down a bit to find the Additional Resources section, on the right hand side of the page. Then click Valuate® to “Analyze investment potential”… and then the continue button.

An RPR/Valuate®/BOTE walkthrough

The numbers for your potential deal are actually crunched using Valuate®, one of RPR’s service and data partners.

Note: When clicking over to the Valuate® site, you are leaving RPR and accessing Valutate®, as a third party additional resource. Therefore, there is an important disclaimer that Valuate® is provided as a free benefit to RPR users. RPR is not responsible for information or conclusions that may be reached using the tool. Also note that RPR passes through to Valuate® only the data needed to perform this analysis.

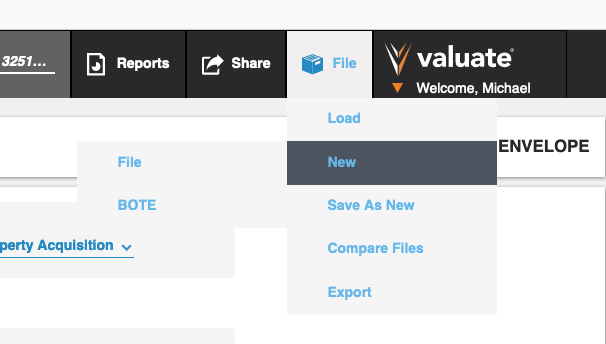

Once you’re in Valuate®, you can assess a commercial investment in land development for multi-family dwellings or buildings. To get to the back of the envelope calculators, you will want to hover over the File tab, then the option of New, and finally click on BOTE, which stands for Back of the Envelope.

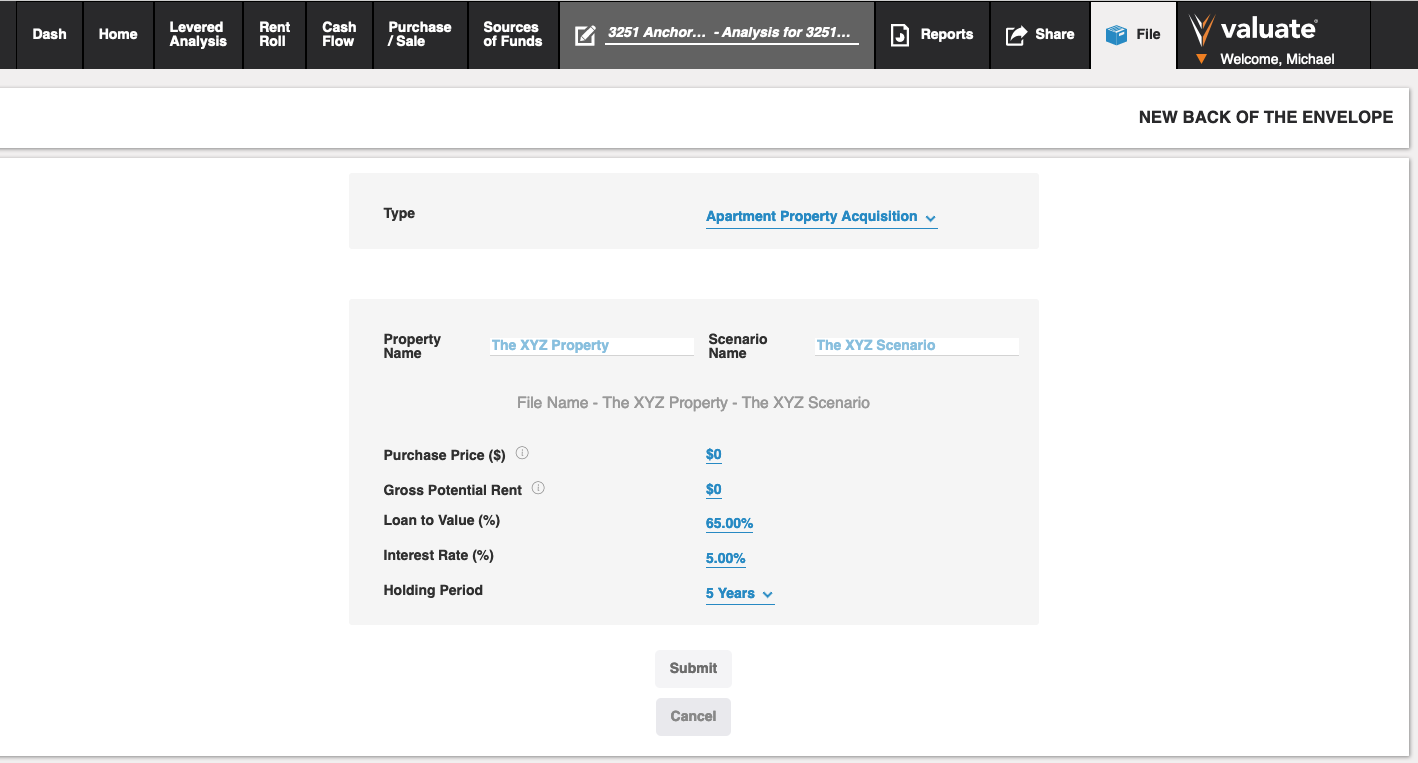

There are multiple options for you to choose from, including Office, Apartment, Condo and Industrial Developments. The quick load screen will change slightly based on your selection, but they all function the same way.

Make your choice based on your chosen property, then enter in the property name, scenario, and basic details of the development, such as the number of units, square footage, income and expenses from the property, etc. Be sure to plug in any areas necessary. Then select Submit.

Back of the envelope calculator

You’ll be redirected to the calculator where you can fill in the rest of your assumptions. Build out your timelines, use of funds, project cash flows as well as expenses and ultimately determine what the current stabilized Net Operating Income Yield on Cost is for your potential development.

The analysis also reveals the cap rate, and the cash on cash rate. (You typically want your cash on cash rate to be higher than your cap rate.) You can play with the numbers to find out where your purchase price needs to be to get right side up on your deal, etc.

If you want to take it to the next step, you can also look at profit ratios should you sell this development project once it is fully leased and is creating a stable cash flow by filling in the fields in the Analysis for Sale upon stabilization section with your projections.

BOTE note

Quick back of the envelope run throughs are great for preliminary research and opportunity quests. You can basically rule out a potential investment before you commit too much brain power to a more thorough analysis or a fully developed pitch to an investor.

Take advantage of RPR Commercial and its partnership with Valuate® by plugging in some rough estimates to see if your multi-family property opportunity gets a thumbs up or a thumbs down.

And if you have time, watch this video for a demonstration: Investment Analysis With Valuate®.

Share This Story, Choose Your Platform!

One Comment

Leave A Comment

TOPICS

AUDIENCE

CATEGORIES

TUTORIALS & GUIDES

SUCCESS STORIES

PROSPECTING

THE PODCAST

This is a great addition to RPR! Can’t wait to try it! K